Financial planning and management is the vital to any kind of lucrative and successful business; listed below are some ideas.

As a company owner, having some crucial strategies for effective financial management is definitely basic. It is something that really should be one of the very first goals when setting up a business, as presented by the France financial services market. Moreover, one of the very best financial management practices examples is to learn exactly how to budget plan effectively. Doing the proper research and putting together a realistic and practical budget is a great starting point for any kind of company. In the early days of company, it is very easy to get carried away with the spending; having a budget is a great way to stay on track and not be too frivolous with non-essential costs. When you get into the behavior of budgeting, you should also start putting aside some financial savings into an emergency fund. With markets continuously going up and down and consumer needs altering, beginning a company can be a costly and high-risk move. By having some emergency funds to fall-back on, it takes some of the pressure off and provides a little bit of security.

Within the competitive business environment, the importance of business finance is something which comes up time and time again. When managing your business finances, one of the most essential things to do is take note of your business cash flow. First and foremost, what is cash flow? To put it simply, cash flow refers to the money that goes into and out of your company over a specific time period. Simply put, money enters the business as 'income' from customers and clients that buy your product or services, but it flows out of the business in the form of 'expenditure', such as rental payment, incomes, month-to-month loan settlements and payments to distributors, and so on. Among the largest issues that a business can deal with is experiencing a negative cash flow, which is where more money is moving out of your company than what is entering. This is not always a business-ending situation, as long as it is only short-lived and the business has the ability to rebound relatively swiftly. Since cash flow is so essential, one of the most effective ideas is to track your company cashflow on a weekly or monthly basis, commonly through financial evaluations and reports. Consistently tracking cash flow and correctly reporting it is one of the central foundations to developing financial propriety, as shown by the UK financial services industry.

When it comes down to starting up a company, there are many different things to organise all at once. Nonetheless, out of the multiple factors to handle, the financial element of the business is probably the most vital thing to prioritise. As a company owner, it is your responsibility to comprehend exactly how to manage business finances in a way which is straightforward, sensible and legitimate. Among the best ways of managing business finances is to keep the business finances and individual finances as separate as possible. Keeping a clear separation in between your own personal and company funds is vital, especially due to the fact that blurring the line between the website different financial resources can create confusion and in severe cases, legal complications. As a brand-new company owner, the very last thing you want to do is possibly entangle yourself up in any lawful dilemmas, especially since financial propriety is the cornerstone of a successful business, as seen with the practices supported by the Malta financial services field and similar entities.

Neve Campbell Then & Now!

Neve Campbell Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Heath Ledger Then & Now!

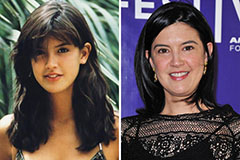

Heath Ledger Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!